Rajesh Bhayani | Mumbai

Last Updated at January 3, 2020 22:37 IST

Feb gold goes past 40K on MCX, but spot market remains subdued as consumers shy away from making purchases at high levels

The price of gold in Mumbai’s Zaveri Bazar marched towards the Rs 40,000 level after a US attack on Iran airport killed several of the Gulf nation’s army leaders. While, the metal’s price has been rising for past two weeks, today’s surge is one of the most pronounced as it was aided by a weak rupee as well.

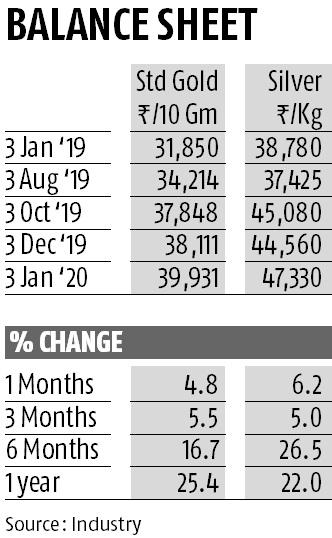

Standard gold ended at Rs 39,931 per 10 grams, up to Rs 873 or 2.24 per cent over yesterday’s close. The international price was quoting at around $1,549 an ounce following reports of the US airstrike. At the same time, the Indian currency continued depreciating against the dollar, making imports costlier. Silver added Rs 990 to close at Rs 47,330 per kg.

During the past three weeks, gold in Mumbai has gained Rs 2,200 per 10 grams. The price movement now depends on how the Iran issue escalates. However, high prices in the local market, along with the ongoing inauspicious period, have hit demand.

On the Multi Commodity Exchange, February gold has already crossed Rs 40,056. The Zaveri Bazar spot price is quoting lower, because the market is trading at a discount due to lack of demand at higher levels. The spot market price is $9-11 per ounce or Rs 200-250 per 10 gram lower than the cost of import. This has temporarily reduced the import of the metal.

Bullion buying is expected to remain low till January 14, due to the ongoing inauspicious period for dealing in precious metals and property. The fact that Several jewellers have received recovery orders from the Income Tax department has also contributed to the weak sentiment. And now, with the price heading towards Rs 40,000, demand has fallen sharply the past few days.

The overall demand scene has been quite optimistic during Diwali took short-term hit later. Compared to last January, demand is 20-30 per cent lower in different regions,” said a leading jeweller in Zaveri Bazar, requesting anonymity.

Debajit Saha, senior analyst, India & UAE, at GFMS said, “Gold import in last 2-3 months has improved over the September quarter. In November, imports were strong at 61 tonnes and December is estimated to be around that level. However, the total domestic supply will still fall short by 23 per cent in the quarter ended December.”

Some jewellers are hoping demand will revive after a fortnight when the inauspicious period ends. By mid-January, the US and China are also expected to sign the first phase of a trade deal that could halt the rally and bring about a correction in gold prices.

Rajiv Popley, Director, Popley Group, said, “Consumers are realising that gold prices will remain elevated this year and that is why we are seeing demand for Pongal and bookings for Sankranti (on 14 January).” He said non-resident Indians and the wedding season have also given a boost to demand. So, while year-on-year demand may be low, sequentially it is good.

Popley Store Address

Popley – Bandra | Popley – Opera House | Popley – Dubai